- Moby

- Posts

- Internal | 11.18.2026

Internal | 11.18.2026

Moby Polls | AI: Mixed Signals?Bezos barrels into AI and Berkshire dives into Alphabet, just as Thiel trims his Nvidia stake and Burry taps out saying markets have “lost the plot.” How’s your confidence in the AI story holding up? |

🌤️ Good morning!

Larry Summers just laid a very awkward grenade on OpenAI’s boardroom table. The former Treasury Secretary and Harvard president, who’s spent decades ping-ponging between academia, Democratic policymaking, and big-picture economic punditry has gone from “global macro sage with some interesting gender opinions” to “Epstein pen pal seeking dating advice” in a single Harvard Crimson exposé. Now he’s “stepping back from public commitments,” which reads like the polite version of “I’m finally an honest-to-god pariah.” Summers sits on OpenAI’s board, so Sam Altman suddenly has a fresh crisis cameo in a news cycle already coughing smoke. If Summers is the canary, the mine could get crowded fast. The House is reportedly set to vote on releasing the files later today.

Home Depot nails… not much: HD rolls out Q3 earnings pre-market, just in time for housing starts and building permits to confirm what everyone already knows: the consumer is tired, and so is construction. Mortgage rates may be slipping, but demand isn’t sprinting back. Builders still need permits, and homeowners still aren’t lining up for granite countertops. Bonus irony: August construction spending came in hotter than expected, but thanks to the shutdown, we got that gem (checks watch) yesterday. So economists can plug in that data with a shrug emoji.

Medtronic and AECOM try their luck: Medtronic clocks in with Q2 before the bell, trying to defend its med-tech turf while navigating a slow rebound in elective procedures. AECOM drops Q4 results too, hoping infrastructure buzz translates to actual margin. Both could move, but after the recent bloodbaths, nobody’s betting the day on it.

Bottom line: Between soft housing prints and stale macro data, clarity is in short supply. Markets may have to wait for a real catalyst… or just make one up. Speaking of which, Nvidia reports tomorrow!

Amazon and Blue Origin founder Jeff Bezos is coming out of retirement to hop on the AI train.

Bezos is launching a new startup called Project Prometheus a not-so-subtle reference to the Greek myth of the Titan who helped humanity by stealing fire from the gods only to eventually be chained to a mountain for an eternity of suffering.

The surprise tech investment lifted Alphabet stock 3%, but it wasn’t the Oracle pulling the strings on this one.

Alphabet’s stock jumped 3% on Monday because Berkshire Hathaway disclosed a $4.3 billion stake. Some of the headlines were some play on “Warren Buffett bought Google,” but the thing is, he didn’t. His name is on the filing because that’s how the SEC works. But the odds that Buffett suddenly became bullish on cloud margins and AI inference with weeks to go in his incomparable career are about the same as him soft-launching a TikTok.

Netflix-and-chill? Netflix-and-split.

The king of at-home streaming is capitalizing on a strong year. The company officially split its shares 10-to-1 at the start of the trading day on Monday, after the entertainment giant posted months of strong growth in its three-year-old advertising business and on its top and bottom line.

The Dubai Airshow opened with a mega-order for 65 more 777-9s, bolstering U.S. aerospace headlines while Boeing’s beleaguered CEO braces for years of certification migraines.

Emirates placed an order for 65 more Boeing 777-9s on Monday, worth $38 billion at list prices, which is great news if you make simplistic PowerPoints in the Trump Administration or are a Boeing sales rep who drinks Red Bull for breakfast. It’s less great if you’re Kelly Ortberg, who now has to deliver them.

Thiel sold hundreds of thousands of Nvidia shares before big Q3 earnings this week.

Between delivering a four-part lecture series on the Antichrist at the Commonwealth Club in San Francisco (because of course he is), billionaire investor Peter Thiel found time to quietly offload a chunk of his AI darlings. Specifically, his fund, Thiel Macro, sold about 537,742 shares of Nvidia last quarter. That’s roughly $100 million, based on the chipmaker’s $160 share price at the end of September, according to SEC filings reported by Reuters.

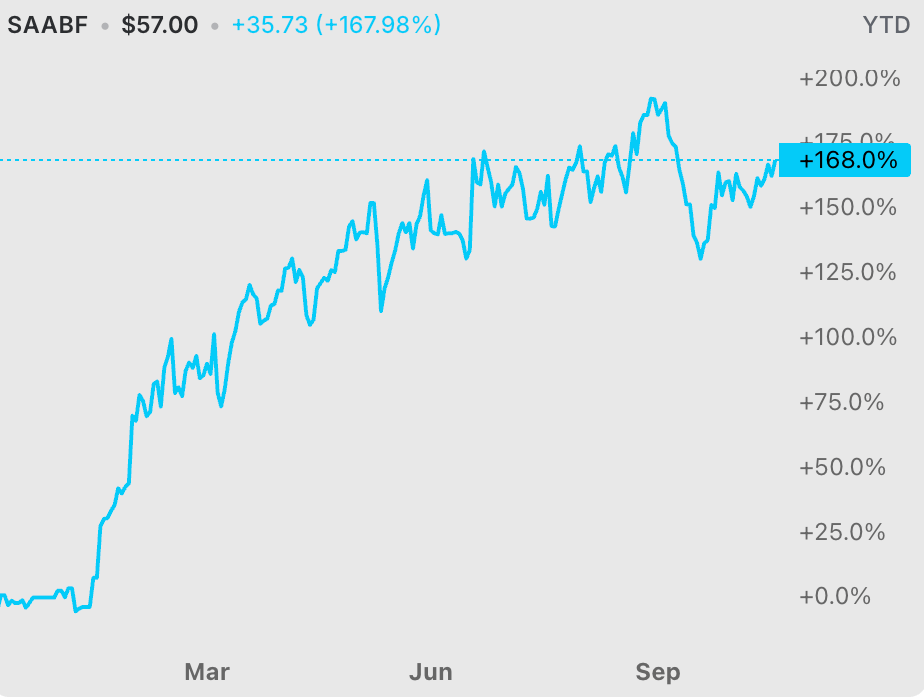

A multibillion-euro fighter-jet deal turns Colombia into the newest Gripen operator, and sends Saab’s stock rocketing to fresh highs.

Saab has secured a €3.1 billion deal to supply Colombia with 17 Gripen fighter jets, sending its shares up nearly 8% and extending a year of explosive gains.

The order secures long-term revenue, enhances Saab’s export credibility, and marks one of the most significant defense partnerships ever signed between Sweden and a Latin American nation.

Ubisoft executives postponed disclosures and suspended trading, sparking even more new concerns about stability across the gaming studio.

Ubisoft, the international gaming studio with titles such as Assassin’s Creed, the Tom Clancy series, and Far Cry, had an unusual earnings call last week as they were set to publish their financial results from the first half of this year.